Figure Out What You Owe With Polston Tax.How the Tax System Works With Multiple Income Streams.All of the aforementioned are relatively small increases from 2016. The credit is $3,400 for one child, $5,616 for two children, and $6,318 for three or more children. Married Filing Separately, Estates and TrustsĢ017’s maximum Earned Income Tax Credit for singles, heads of households, and joint filers is $510, if the filer has no children (Table 9). 2017 Alternative Minimum Tax Exemption Phaseout Thresholds Filing Status In 2017, the exemption will start phasing out at $120,700 in AMTI for single filers and $160,900 for married taxpayers filing jointly (Table 8. Under current law, AMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold. In 2017, the 28 percent AMT rate applies to excess AMTI of $187,800 for all taxpayers ($93,900 for unmarried individuals). 2017 Alternative Minimum Tax Exemptions Filing Status The AMT exemption amount for 2017 is $54,300 for singles and $84,500 for married couples filing jointly (Table 7). The AMT is levied at two rates: 26 percent and 28 percent. However, this exemption phases out for high-income taxpayers.

To prevent low- and middle-income taxpayers from being subject to the AMT, taxpayers are allowed to exempt a significant amount of their income from AMTI. The AMT uses an alternative definition of taxable income called Alternative Minimum Taxable Income (AMTI). The taxpayer then needs to pay the higher of the two. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. 2017 Personal Exemption Phaseout Filing Status

2017 Pease Limitations on Itemized Deductions Filing Status PEP will end at $384,000 for singles and $436,300 for married couples filing jointly (both will increase from 2016), meaning that taxpayers with AGI above these limits will no longer benefit from personal exemptions. The income threshold for both PEP and Pease will increase from last year to $261,500 for single filers and $318,800 for married couples filing jointly (Tables 5 and 6). House Representative Donald Pease) phases out the value of most itemized deductions once a taxpayer’s adjusted gross income reaches a certain amount. PEP is the phaseout of the personal exemption and Pease (named after former U.S.

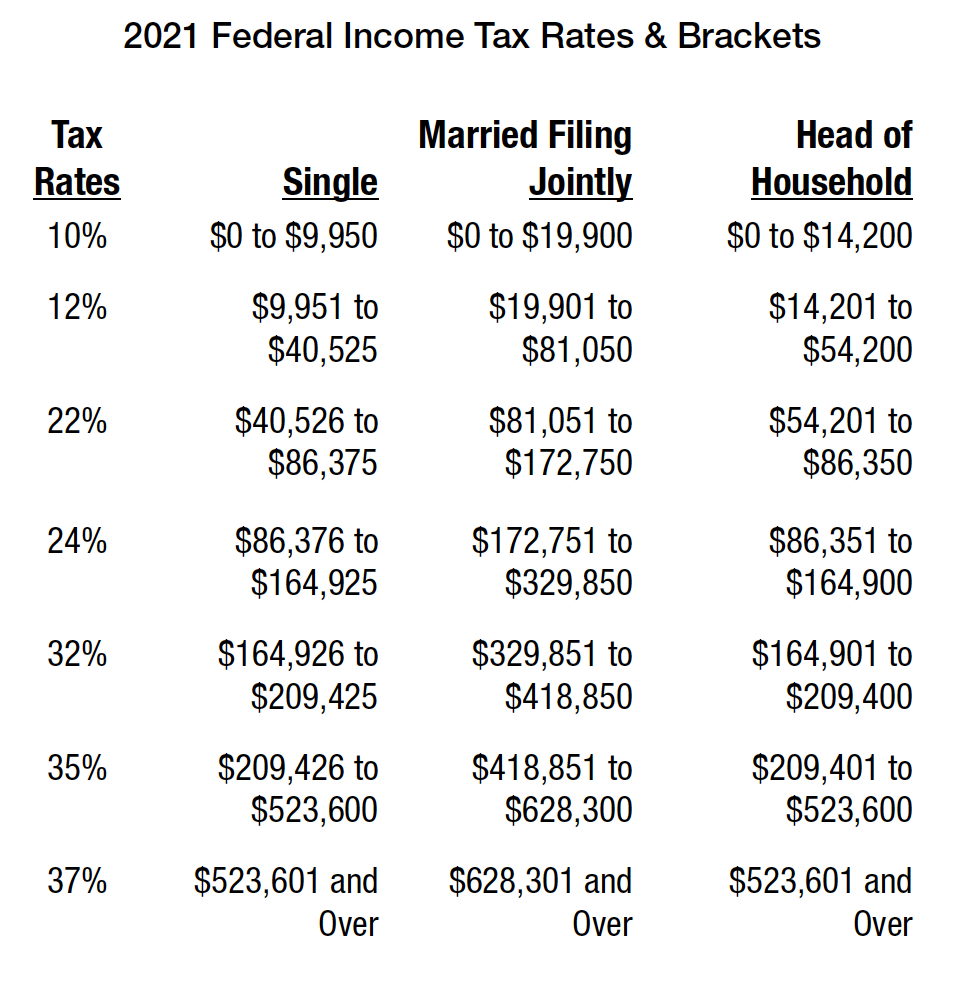

FEDERAL TAX BRACKETS 2021 CODE

PEP and Pease are two provisions in the tax code that increase taxable income for high-income earners. 2017 Standard Deduction and Personal Exemption Filing Status The personal exemption for 2017 remains the same at $4,050. The standard deduction for single filers will increase by $50 and $100 for married couples filing jointly (Table 4). Standard Deduction and Personal Exemption Head of Household Taxable Income Tax Brackets and Rates, 2017 Rate Married Filing Joint Taxable Income Tax Brackets and Rates, 2017 Rate Single Taxable Income Tax Brackets and Rates, 2017 Rate The top marginal income tax rate of 39.6 percent will hit taxpayers with taxable income of $418,400 and higher for single filers and $470,700 and higher for married couples filing jointly. In 2017, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). Launch Now Estimated Income Tax Brackets and Rates

0 kommentar(er)

0 kommentar(er)